Here are three interviews conducted by the journalist Kohei Takeda for the Japanese economic magazine DIAMOND WEEKLY, on their website DIAMOND ONLINE.

Here are the headlines and beginnings via Google Translate.

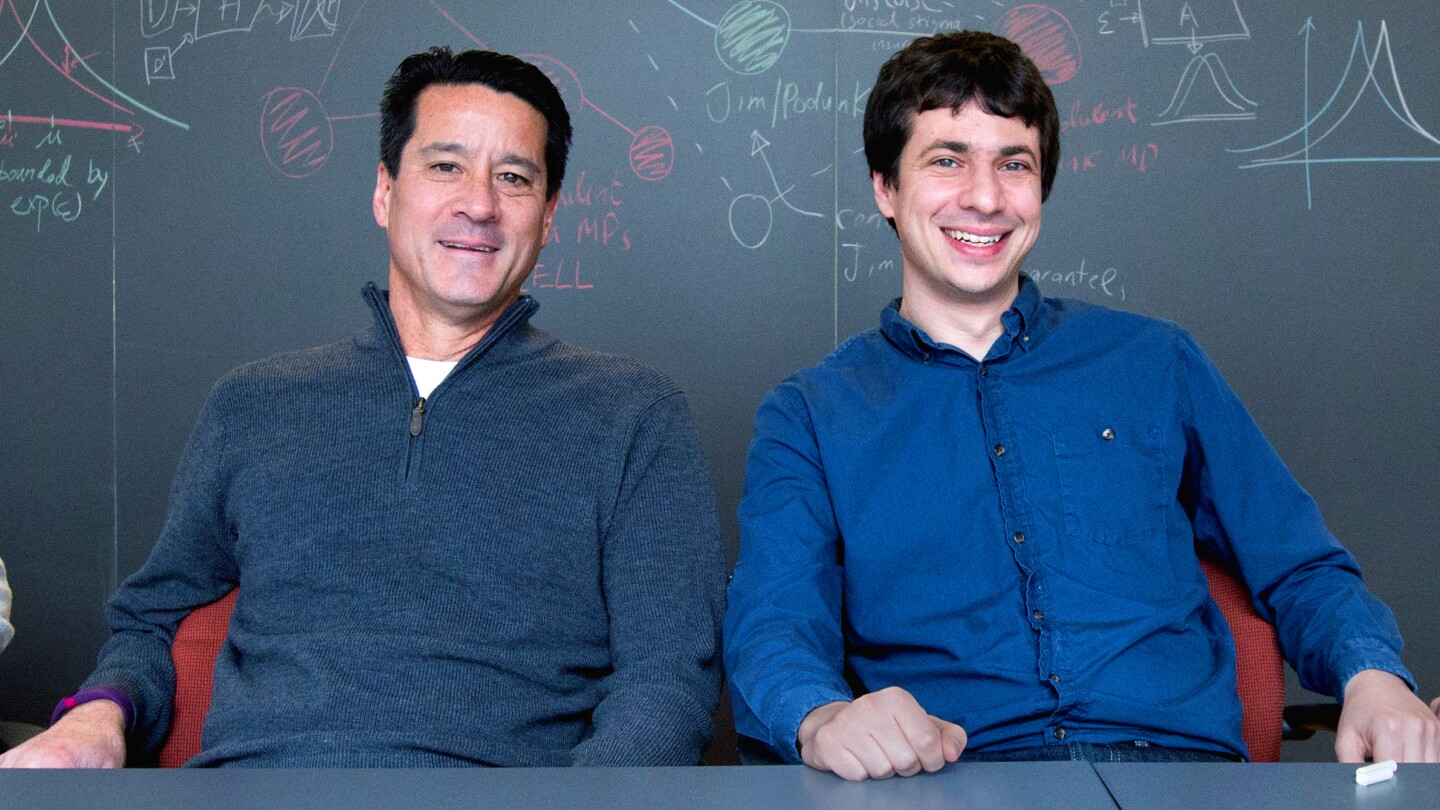

The essence of the Nobel Prize in Economics "Game Theory", explained by a former colleague of the award winner--Interview with Fuhito Kojima, Professor of the University of Tokyo, Director of Market Design Center, University of Tokyo by Kohei Takeda : Reporter

The interview begins with these opening words from Fuhito:

"Eight years ago, when Al (Professor at Alvin Roth Stanford University), who I had been taught, received the award, we held a grand celebration and press conference. I thought I couldn't do that this year due to the spread of the new coronavirus infection, but in the evening of the award day (October 12), planned by him and his wife Emily, in the garden of Al's house. A small celebration was held while keeping a certain distance from each other.

"At universities in the United States, teachers and students tend to live very close to the campus, so fellow researchers have more relationships with their neighbors. I still lived near the university, so I received an invitation email from Emily on the day and participated in the celebration. ...

"To me, Paul was a colleague at the university, but he is also like a mentor. After I got a job at Stanford University about 10 years ago, my research field was the same "market design" in the Faculty of Economics (Editor's note: one of the research fields of game theory) , and sometimes I wrote a co-authored paper. , I was able to build a good relationship.

"He is a major researcher I have known since I was a student... Bob taught both Al and Paul, so academically I'm also Bob's "grandson."

************

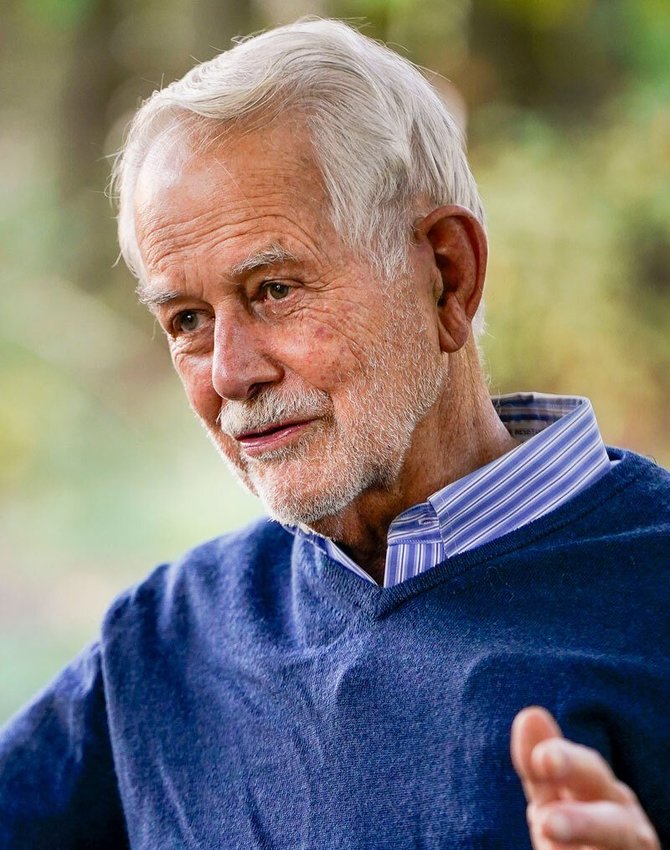

2020 Nobel Prize Winner "Auction Theory for Business" Special Lecture--Interview with Professor Emeritus of Robert Wilson Stanford University by Kohei Takeda : Reporter

The first thing Bob was asked to explain was his work on the winner's curse:

"I started working in this area in the 1960s. The background to this was the issue of oil drilling rights among US oil companies at that time. They had very incomplete information about what their oil reserves were. From the size of the oil field to whether or not it was filled with hydrocarbons, there were many things we didn't know. Oil companies were under pressure to estimate their reserves in such an unknown environment.

"When auctioning under these circumstances, each participating player tends to overestimate in order to win the bid. In this case, each estimate is a function to increase the likelihood of bidding, but oil companies face the challenge of significantly lower rates of return after investing in oil rigs. Was there.

"Eventually, this is (in a situation where each player does not have the same information, the information is asymmetrical, and the player eventually chooses the less valuable one in an attempt to maximize his or her profits). (Adverse selection) ”was recognized as a problem. In other words, there was a tendency to win bids only when overestimating.

"What I have built is a theory for bidding various things in the best possible way, taking into account the situation of such adverse selection. This achievement has attracted a great deal of attention and is one of my early achievements in research. The negative effect of overestimating what is being bid on and winning the auction has been called "Winner's Curse". However, the best bidding strategy takes its existence into account, so you won't suffer from the curse of the winner."

***********

Nobel laureate in economics "Matching theory that can be used in business" --Interview with Professor Alvin Roth Stanford University by Kohei Takeda : Reporter

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22011589/marijuana_legalization_laws_map.png)