From the Harvard Gazette, March 3, 2021

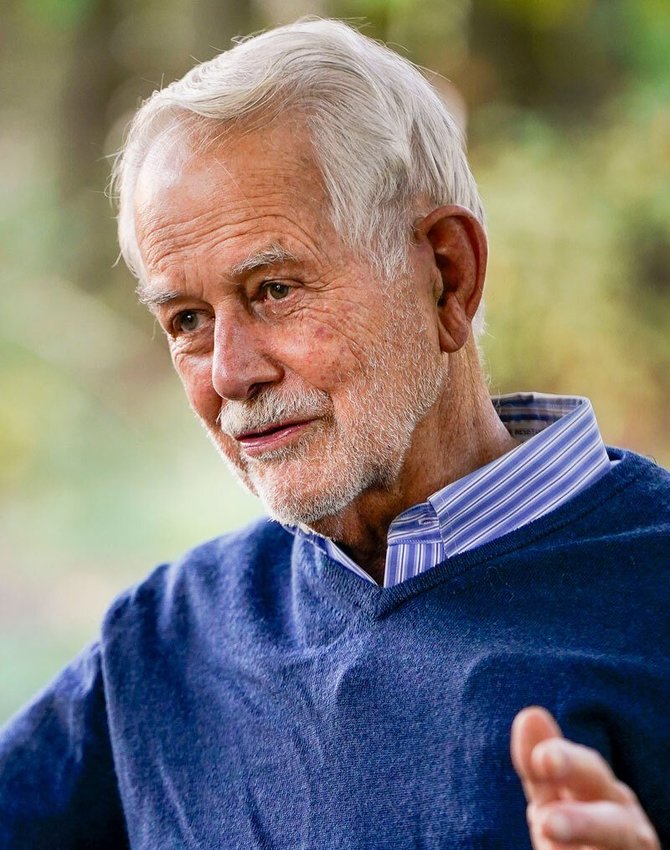

Thomas Crombie Schelling, 95. Memorial Minute — Faculty of Arts and Sciences

submitted by Eric S. Maskin, Amartya Sen, Richard J. Zeckhauser, Benjamin M. Friedman

"Thomas C. Schelling taught at Harvard for 32 years, in the Department of Economics and in the Kennedy School. More than any other thinker, Schelling influenced the West’s conceptual approach to the nuclear dangers after World War II. He was an outstanding economist, but ordinary disciplinary boundaries could not contain his fertile mind. Schelling’s contributions interwove theoretical understanding and policy-relevant applications. He laid bare the underpinnings of such problems as nuclear deterrence, racial segregation, smoking, and climate change. Schelling eschewed mathematical expression; he wrote in plain but elegant English. He often developed ideas using examples from everyday life and then applied them to global issues. For instance, he illuminated the architecture of threats and promises first within the family and then in international affairs.

...

"The Nobel Prize committee wrote that Schelling’s insights proved “to be of great relevance for conflict resolution and efforts to avoid war,” and, unsurprisingly, he devoted his Nobel lecture to what he called the “nuclear taboo.”

"As the threat of nuclear war receded, Schelling applied his characteristic approach to other big problems. He analyzed the damage, to both the individual and society, of smoking and other personal addictions. He anticipated future work in behavioral economics and psychology with his working assumption that often what appears to be irrational behavior of an individual is instead a reflection of different aspects of that individual’s self. He probed the problem of racial segregation and showed how easily it can arise even if people have only a tiny preference for their own race. In his final decades, Schelling’s principal focus was climate change. That concern was not new for him; in 1980 he chaired the Ad Hoc Study Panel on Economic and Social Aspects of Carbon Dioxide Increase, under President Carter."

***********

Previous posts: